In a bold move, former President Donald Trump announced significant tariffs on imports from Canada, Mexico, and China, citing national security concerns and drug trafficking. The tariffs, which took effect on March 5, 2025, included a 25% tax on imports from Canada and Mexico, along with a 10% additional tariff on Chinese goods. This marked the largest U.S. tariff increase since 1943.

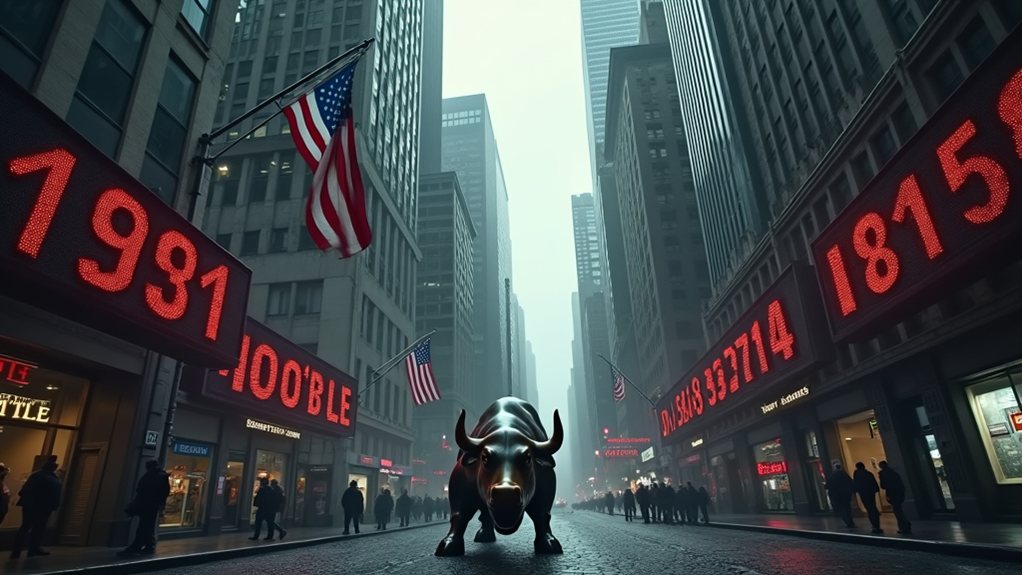

The economic impact on the United States was notable. Experts estimated that the tariffs could reduce the long-run GDP by 0.2% due to the tariffs. Car prices could rise by up to $3,000, while gas prices in the Midwest might see an increase of 50 cents per gallon. Overall, the total tariffs could reach $79 billion, leading to a drop of at least 2% in stock market indices right after the announcement. Additionally, retailers like Target and Walmart reported declines in consumer spending due to inflation.

Canada quickly responded with its own tariffs. Prime Minister Justin Trudeau announced a 25% retaliatory tariff on $155 billion worth of U.S. goods, starting with an initial $30 billion. The remaining $125 billion would follow in 21 days, targeting items like U.S. beer, bourbon, and appliances.

Trudeau criticized the tariffs, calling them "a very dumb thing to do."

Mexico also planned to retaliate. President Claudia Sheinbaum stated that she would announce specific measures soon. She called the U.S. tariffs "inconceivable" and stressed the need for cooperation on issues like fentanyl and border security.

China's reaction included 10-15% additional tariffs on U.S. goods, affecting products like chicken, wheat, and beef. These tariffs were set to take effect for goods shipped from March 10, 2025.

China also expanded export controls on U.S. companies, building on previous tariffs from the 2018 trade war.

The global trade landscape faced disruption as the U.S. average tariff rate climbed from 2.4% to 10.5%. The situation created uncertainty for businesses and investors, hinting at a possible escalation of the trade war.